These days, new apps spring up like mushrooms, with around 2.8 million apps available on Google Play and approximately 2.2 million on the Apple App Store.

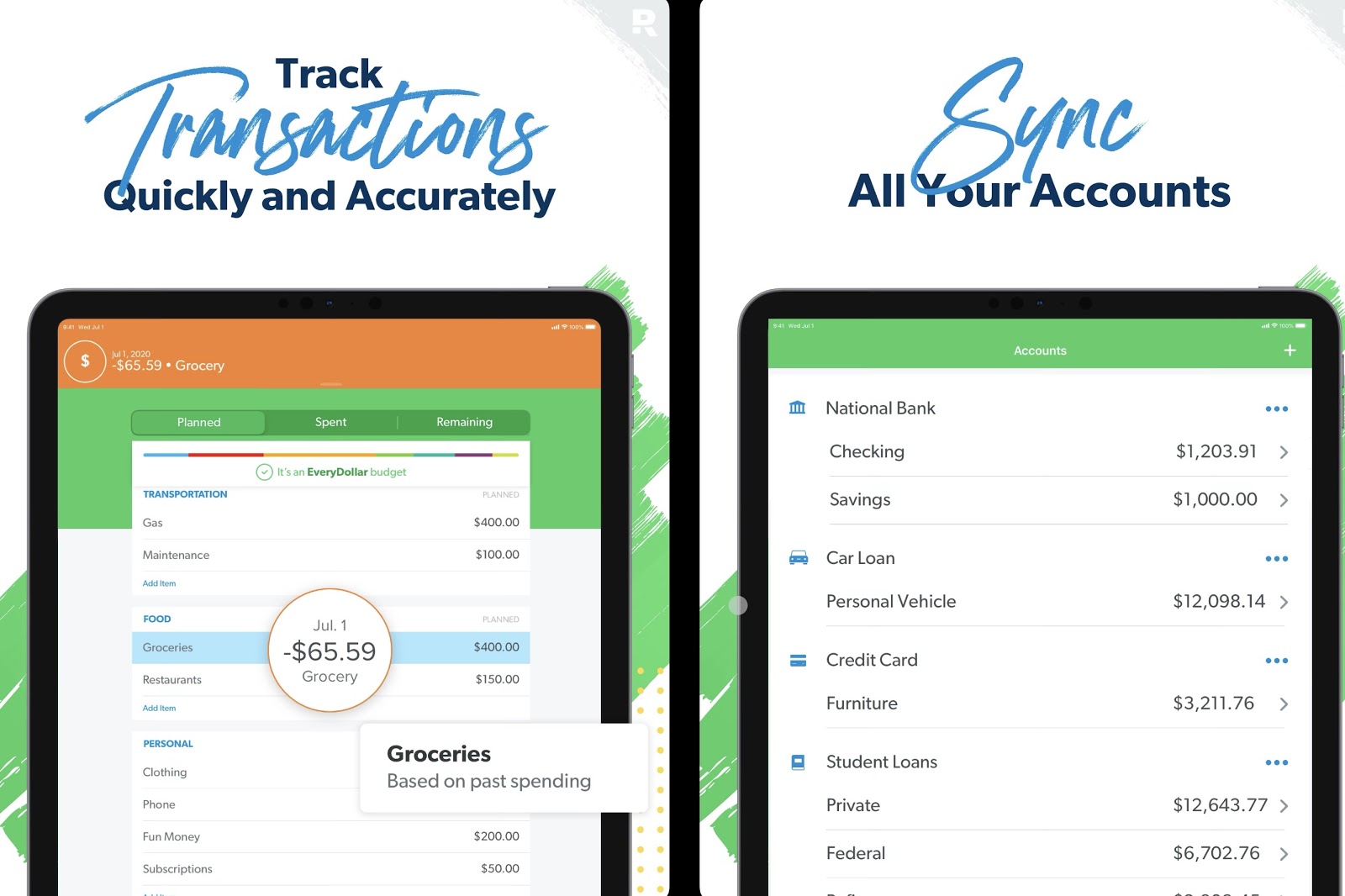

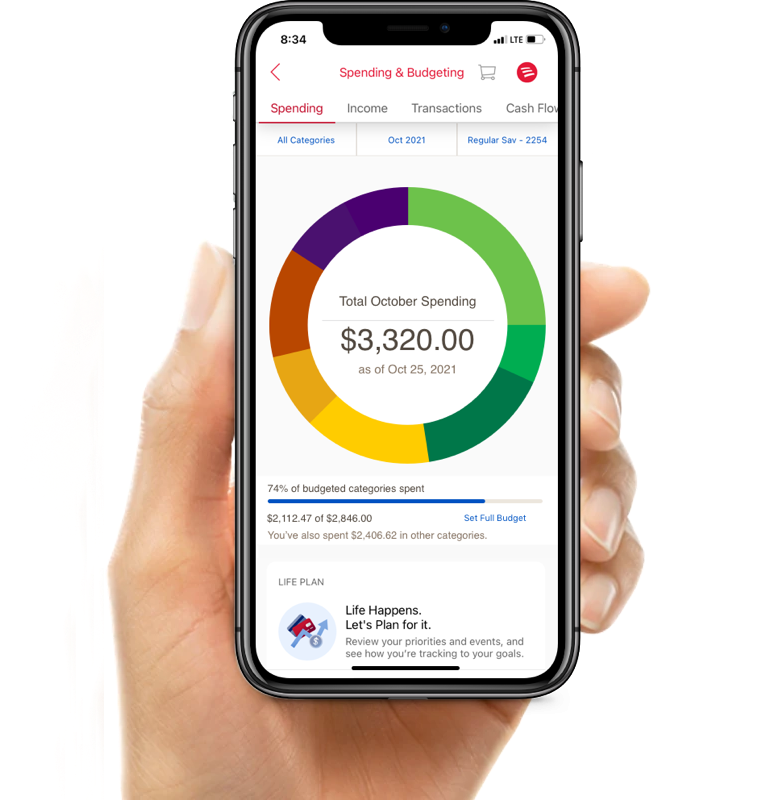

This lays out a bright future for sustainable finance products, open finance, fintech companies, and technologically skilled fintech talent. We’ve seen fintech focusing on the users who struggle with money management, as well as those aiming for financial freedom.Īccording to Forrester, in 2022 banks will achieve double-digit growth and accelerate their digital transformation even further. Creative solutions that make managing money easier have been an especially successful branch of financial products for a while now. In the end, you should have a complex overview of all business and technical aspects that will help you start a finance app and increase your chances of success - and how EPAM Startups & SMBs is here to help you achieve those goals.Ģ022 kicks in with continued growth of digital banking and increased adoption of Personal Financial Management (PFM).

Budget app linked to bank account how to#

In this article we will explain how to create your own budget app - the market constraints and opportunities to consider, an overview of types of apps as well as user needs in the field, essential features, proper tech stack, and the processes involved in executing it all. That being said, the market has grown so much that we now see finance apps targeted at the particular needs of different groups: people dealing with economic instability, those monitoring their savings and investment performance, and sectors such as couples, families, or groups of friends, sharing costs, and more. In general, personal budgeting apps help people navigate their spending and savings. Also, with Gen Z transitioning into adulthood as the first generation who finds using technology completely natural in all aspects of their life, the need for financial applications and innovation in the field is on the rise. Personal finance apps have been in high demand for a while now, and the global pandemic made people even more observant about their spending.

0 kommentar(er)

0 kommentar(er)